In response to recent press about the Help to Build equity loan scheme, NaCSBA wanted to set out its approach to the scheme, which it believes has huge untapped potential for the sector. However, despite this no applications have been approved to date.

Background – Help to Build

Help to Build was a commitment in the 2019 Conservative manifesto, and, although delayed, it was launched in June 2022Help to Build opens to applications. Help to Build was needed because the main Help to Buy scheme was not suitable for custom and self build – something that was unfair as it supported considerable activity in the speculative housing market.

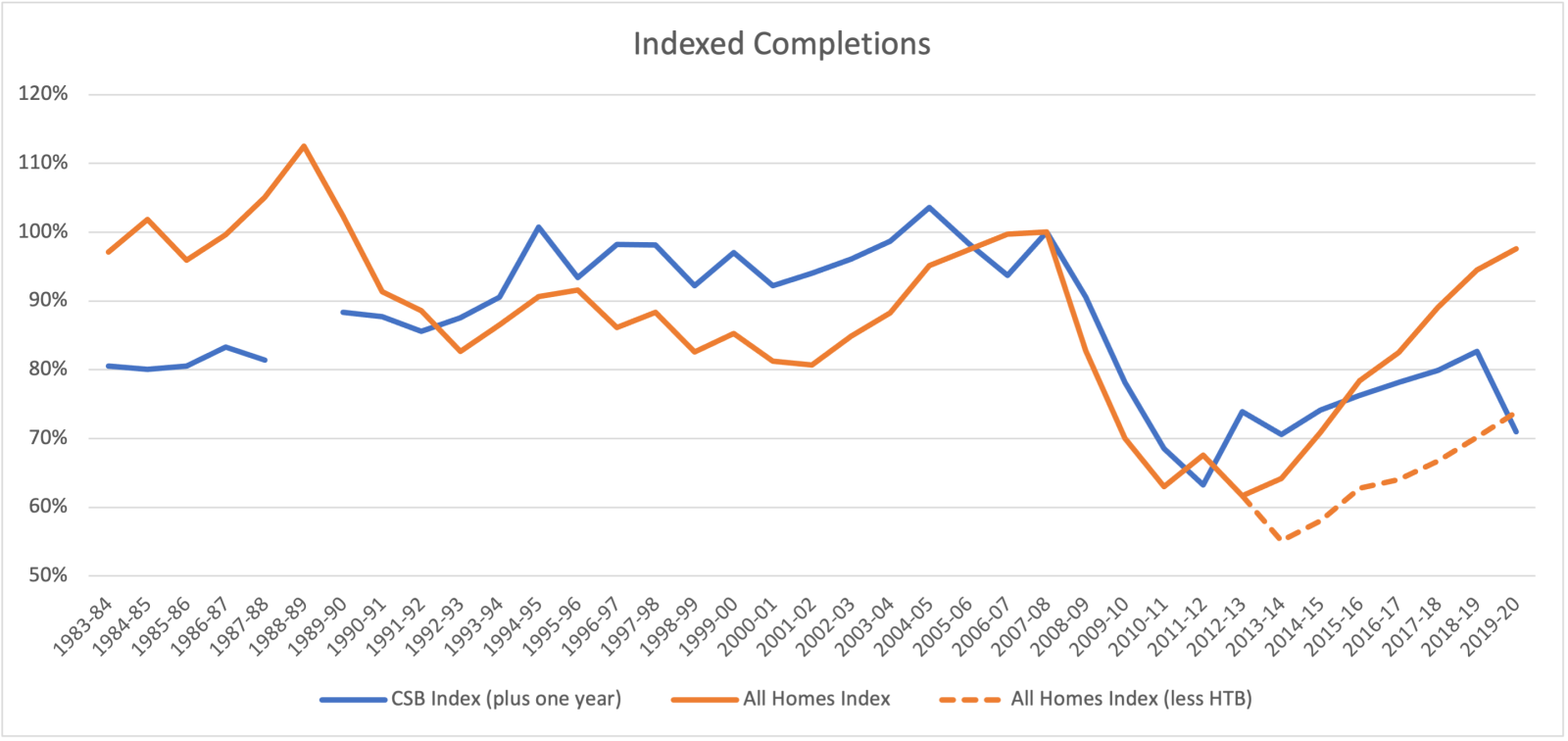

As a consequence, the custom and self build sector did not experience the same recovery in activity as mainstream housebuilding post the global financial crisis. This was also affected by other factors, such as the shift in planning mix to larger sites and materials and labour shortages.

This can be seen in the chart above, which illustrates how, when excluding Help to Buy, the performance of the two sectors since the Global Financial Crisis (GFC) has been similar (data based on VAT returns and ONS figures.

When looking at the data, it should be noted that NaCSBA believes that the most recent drop in custom and self build numbers is covid related – not least in connection with delays in the final completion process.

To redress this balance in help create a fairer system for its members, NaCSBA actively campaigned for Help to Build and the core structure of the scheme was based on our design, developed in conjunction with a range of lenders.

Addressing some of the criticisms – NaCSBA’s response:

Lack of approved applications

NaCSBA has consistently advised government and Homes England that the scheme would have a slow start. Applications can only be made when land with permission is secured, and to get to this stage requires certainty of the scheme being in place.

In short, the process could not start before the product was launched and even then, there would be a lag before applications were made.

More than this however, the scheme plays an important role as a catalyst for the growth of the sector. Only with the scheme in place will there be the confidence for landowners to bring forward more plots, the confidence from councils to plan for and approve such sites and the readiness of enablers and custom build developers to offer their products.

In turn, we need the visibility of sites with flags to help promote the scheme, and marketing material to attract those who are able to self commission a home, but who may not previously have had awareness of – or access to – the market. This is what will grow the market.

In summary, Help to Build is not just a support for those with smaller deposits, it is a public statement of confidence in the sector and a desire for it to grow. This sends out a positive message to local authorities, landowners, enablers and the wider sector that custom and self-build is for all.

It is an enabler of wider activity but this will take time – in comparison, Help to Buy had 10 years, as well as an existing market to launch into.

Challenges with the design of the scheme

The part of the scheme whereby the government benefits from any uplift in value through the course of the self-build was not a feature of the scheme that NaCSBA proposed. Nor was it a feature that we supported, but rather one that we sought to change.

In effect, this mechanism amounts to a ‘tax’ on the time and effort put into the scheme by the self-builder. It is especially punitive where the self-builder undertakes much of the work themselves or already owns the land, and in London the value that is created by the self-builder could be ‘taxed’ at up to 40%.

This factor is likely to be less significant where the scheme is a custom build through a single enabler. In this case, more risk and more uplift is transferred to the enabler and hence the impact is likely to be less.

This approach is inconsistent with Help to Buy where the builder receives the full uplift they achieve through the build process. It is unsurprising therefore that this element has been identified and is impacting the popularity and use of the scheme, and it would be better if this were to be changed.

NaCSBA also notes thats Help to Buy also needed revisions after it was launched before lenders were willing to support the scheme.

The fact that the Treasury takes a share of the value created by the self-builder through their efforts and judgements is different from Help to Buy, and akin to taking a share of the developer’s profits.

It is clear that the scheme would be more popular and simpler if, instead, the equity stake taken by the government reflected the share of the land and build costs that it had funded.

In summary

NaCSBA firmly believes that Help to Build is an important enabler of a large part of the custom and self build market that, since the financial crisis, has fallen behind the recovery in the speculative build market.

However, it will take time for the impacts of the scheme to flow through into all the elements that are needed to enable the scheme to be used at scale. Consequently, a slow start is not unsurprising. What is needed is an extended period and the greater promotion that will come with more sites.

However, the scheme would be more popular if government followed the Help to Buy model and took a share based on the cost and not the value – enabling all the initial uplift to go to the self builder.

NaCSBA remains happy to work with government to make sure the scheme achieves its full potential.